1 Which of the Following Represent Taxable Transactions

This is applied to the principal payments received in the second year 5251 x 249 1308. For the following year.

Personal Finance Advice How To Make Quick Cash Personal Finance Advice Personal Finance Finance Advice

Brief facts of the case are the Return was filed by the assessee on 30092013 declaring NIL.

. Enter the amount from Worksheet Taxable Gifts line 2 column b field 2. Part 2 starts with the same ratio as in the prior year of 249. The resulting figure is a taxable gain of 1304.

Discover more about what it means to be tax exempt here. This appeal is filed by the revenue against the order of the Learned Commissioner of Income Tax Appeals 33 Mumbai hereinafter in short LdCITA dated 30012020 for the AY2013-14. Tax-exempt is to be free from or not subject to taxation by regulators or government entities.

Taxable gifts made after 1976 that qualify for special treatment. Taxable gifts made after 1976 reportable on Schedule G. Complete Part 1 with the same amounts from the first year.

The taxes may also be referred to as income tax or capital taxA countrys corporate tax may apply to. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level and a similar tax may be imposed at state or local levels.

In the transactions described above the taxable event is deferred for property that the tax-exempt entity immediately uses in an unrelated business. Taxable gifts made after 1976. If the parent later disposes of the property then any gain not in excess of the amount not recognized is included in the parents UBTI.

Enter the amount from Worksheet Taxable Gifts line 2 column c field 3.

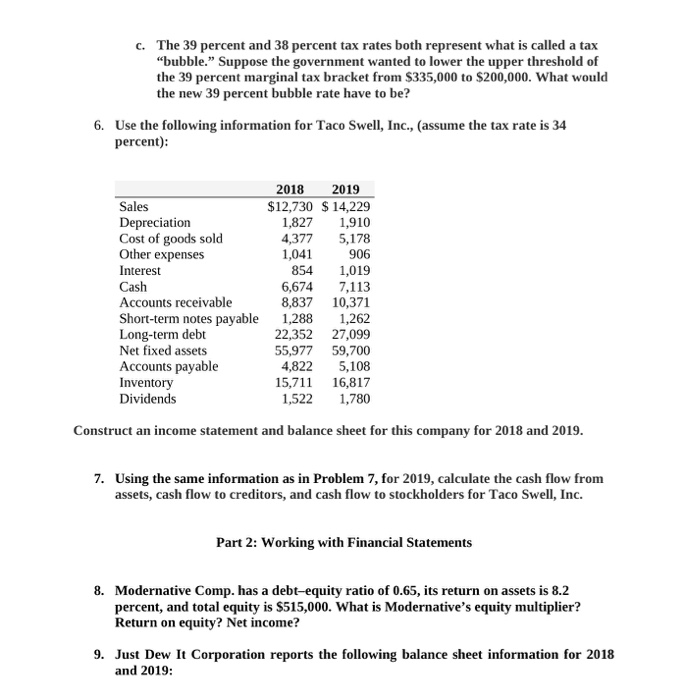

Solved Part 1 Financial Statements Taxes And Cash Flows 1 Chegg Com

How To Negotiate With A Realtor On Commission In Nyc Negotiation Buyers Agent Realtors

No comments for "1 Which of the Following Represent Taxable Transactions"

Post a Comment